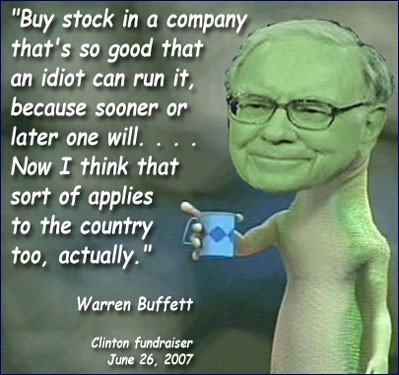

Yesterday was another one of those “make me want to puke” days hearing more lies from Uncle Warren Buffet (plastered across Yahoo Finance) extolling the virtues of how the “little guy” should put 90% of their investment in an S&P index fund.

Let’s pause here.

Before reading further you should know this email intends to kick over another sacred cow.

Said cow is legendary investor (and everyone’s favorite uncle) Warren Buffet.

Why Buffet, you ask?

It’s simple.

Buffet is like a professional athlete who’s well past their prime but insists on competing. And just like the athlete with diminishing skills, Buffet relies on desperate actions to maintain credibility.

What I’m referring to is Buffet’s condescending attitude when telling small investors why they should buy index funds like the Standard & Poor’s 500 instead of individual stocks.

Hey Warren, is that how you made your fortune? (Highly doubtful)

Let’s consider how and why Buffett claims you should buy S&P index funds.

Or is it possible Uncle Warren owns a large position in Vanguard funds (who makes billions in fees from their index funds) and simply want us “little guys” to help bolster another of your holdings? (Very Likely).

He’s a classic hypocrite who pontificates: “Do as I say, not as I do.”

More Lies from Uncle Warren

Many of you might not remember that Buffet was the first in line slurping up taxpayer’s money from the 2008 meltdown.

He desperately needed to be bailed out because, at the time, he was the largest shareholder of AIG.

AIG was bankrupt.

So, Goldman Sachs cajoled stole a huge chunk of the $700 Billion TARP fund to bail out AIG.

And that was thanks to former Goldman CEO – and then current Treasury Secretary – Hank “…Tanks in the Street, Mr. President” Paulson.

Why?

Goldman was on the hook for the debt of AIG and would’ve gone belly-up as well. (Read the full story HERE).

Soon thereafter, Buffett “graciously loaned” Billions of dollars to Goldman Sachs in exchange for “Preferred Stock.” (Compliments of your hard earned tax dollars).

So, when he says the small investor should buy index funds, I cry, “FOUL.”

Before you lose your shirt, read about the unexplained dangers of ETF investing (HERE)

And while you’re at it, upgrade to our premium content before our May newsletter comes out…featuring awesome tips on how to prosper AND thrive in Turbulent Times (HERE).

Share this with a friend…they’ll thank YOU later.

But tell them; “We’re Not Just About Finance.”

https://www.financialsmatter.com/connecting-the-dots/

******************************

Yes, He Said That…

More Stories

The ‘Titanic’ Link to the Federal Reserve

Saturday Rant…More Taxes to Save…

Stagflation Raising Its Ugly Head…Again