How do you know when we’re hearing more lies from the Banksters?

It’s simple.

Any time there’s a crisis (Cough! First Republic Bank Bankruptcy, Cough! Cough!) they’ll be the first to claim that everything is under control…just like they did in 2008.

Cue up Citigroup CEO Jane Fraser who said yesterday that the US banking system is “Strong and Safe.”

Sounds like Fraser took a page right out of Barney Frank’s comments about Fannie Mae in 2008…right before it went bankrupt. *

(* Note: For most of his career, Barney Frank was the principal advocate in Congress for using the government’s authority to force lower underwriting standards in the business of housing finance…enabling the real estate collapse)

Or maybe Fraser was channeling CNBC’s Court Jester (Jim Cramer) from March 11, 2008 who said: “Bear Stearns was fine!” …right before the stock absolutely collapsed.

At the time, Bear Stearns was trading at $62 per share.

Five days later, the firm was bailed out by JPMorgan Chase at $2 per share.

Lies and More Lies from Banksters

The ongoing narrative of lies from Banksters is nothing new.

However, when they use a banking crisis to “invoke eminent domain” is when they have gotten out of control.

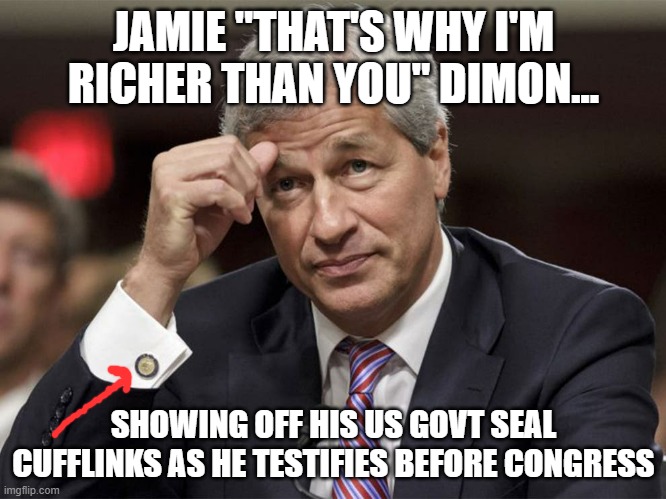

Cue up: JP Morgan CEO Jamie Dimon’s address to shareholders:

This man is beyond creepy.

And he’s adhering to the World Economic Forum’s Agenda 2030 and The Great Reset.

And he believes that our freedoms need to be removed under the excuse of climate change.

“The need to provide energy affordably and reliably for today, as well as make the necessary investments to decarbonize for tomorrow, underscores the inextricable links between economic growth, energy security and climate change. We need to do more, and we need to do so immediately,” Dimon added in his letter.

Next up you can expect the FED (Jerome Powell) to mention the use of CBDC’s as “a safe alternative to traditional banking.”

Nothing could be further from the truth.

Why?

Because CBDCs allow governments to track and control every penny you earn, save, and spend.

And they’re a powerful tool for politicians to confiscate and redistribute wealth as they see fit.

READ: What You Should Know About CBDC’s October 13, 2022

After pounding the table for years, we realize we sound like a broken record here.

But Wall Street AND Government Corruption is totally out of control.

And if you want to even have a fighting chance of surviving what’s coming, you need to learn how to fight back against this evil agenda.

Learn how in our May issue of “…In Plain English” (HERE).

Share this with a friend…especially if they trust Banksters.

They’ll thank YOU later.

And remember:

We’re Not Just About Finance

But we use finance to give you hope.

*****************************************

|

|

You are receiving this email because you opted in via our website.

More Stories

Is This the End of the Western Empire?

Saturday Rant…Iraq on Steroids

New Yorkers With Very Short Memories