The Fed Put is defined as a mechanism by which the Fed (by keeping bond yields/rates artificially suppressed) drives cash into risk assets/stocks.

And when Alan Greenspan was Fed Chairman this “Fed Put,” was previously known as the Greenspan Put.

Because Greenspan repeatedly lowered rates and implemented easy money policies to prop up the stock market during his tenure,1987-2006.

As a result, the mania behind the “Dot-Com” bubble/crash was hyper-inflated via the Greenspan Put.

Ironically (or NOT) it was also his tightening of monetary policy in the Spring of 2000, which allowed the bubble to burst.

And then, following the stock market crash/financial meltdown of 2008, the Fed again brought back the “Greenspan Put,” which has now become known simply as the Fed Put.

But here is the kicker…without exception, every single time that the Fed has implemented a “Put” to prop up stocks, it ends in disaster.

WHY?

It’s simple.

A Fed Put, artificially suppresses rates.

Then, easy money policy drives cash into the stock market which inflates a bubble.

Under normal circumstances cash moves through the markets in predictable patterns.

But artificially suppressed rates open a doorway for cash to make its way into risk assets/stocks.

A Fed Put by Design

By DESIGN, a ‘Fed Put’ causes MASSIVE distortions in the price action of assets.

But…and this is a Very Big Butt… it also creates opportunities.

How, you ask?

A Fed Put causes cash mainly to be pulled from “risk off” assets, such as commodities.

So, the setup here is simple.

As a result, investors, understanding how a Fed Put works, will overexpose themselves to risk assets/stocks… which in turn, further exacerbates and fuels a stock market bubble/hyper-bubble.

On the flip side, assets like commodities (gold, silver, corn, wheat, copper, etc.) remain massively undervalued.

Therefore, the Fed Put gives investors an opportunity to acquire commodities extremely cheaply.

And that is exactly why we have been hollering how we are in the early stages of a major bull market in commodities.

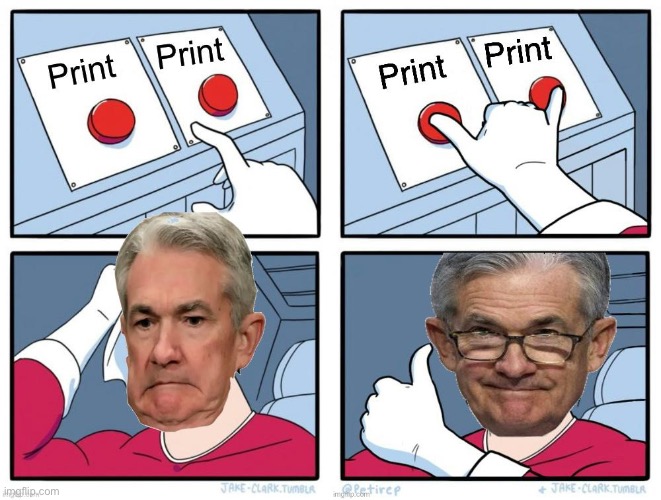

Current FED chairman, Jerome Powell, is stuck in between a rock and a paradox.

Huh?

He sees the Neocons desperately trying to start WW3, which results in reckless spending and rising interest rates.

In the past raising rates impacted the consumer – not the government.

Today, the government is the #1 borrower, so raising interest rates has ZERO impact on the government other than increasing the spending.

And that is why Powell said our debt is “Unsustainable” and the only answer is to PRINT MORE MONEY.

Unfortunately, the FED has no tools to mange the economy anymore…and they are just along for the ride.

But when the public realizes this is when confidence in government really collapses fast.

And as we have been saying, the reason to own gold is NOT as a hedge against inflation…but it is to protect you against loss of confidence in government.

Learn more about this Fed Put, and where to invest for the future in our newly released May issue of “…In Plain English” (HERE).

Share this with a friend…even if they hate the FED for reasons they can’t explain.

They’ll thank YOU later.

And tell them:

We’re Not Just About Finance

But we use finance to give you hope.

***********************************

More Stories

How the Markets Influence Governments

Why the Markets Punish Small Investors

Epstein, the Truth, and Trump