The markets were mixed this week during the Broke Bank Bailout Bash between Wall Street and the District of Caligula.

Cue up: Silicon Valley Bank (SVB) collapse and the ensuing banking crisis unleashed by the O’Biden Administration.

And after puking from 32,374 on the DOW, down to 31,466 the markets recovered most of the losses from panic selling over the reality of a broke bank bailout bash.

Today’s rant is from a 30-year veteran in the banking business who goes by the handle PrettyInPink.

So, take it away PIP:

James, you’ve said it many times how the favorite lines used by politicians and professional liars – when caught lying – is “I’m Shocked, I tell you…shocked. Who could’ve foreseen this happening?”

And that was never more obvious this past week as bank regulators shunned the real problem and denied any responsibility.

The sad truth is most banks are clueless when it comes to risk management.

If they were honest (they’re not) they wouldn’t have loaded up on long-term bonds during the peak of low interest rates.

Instead, they ignored the risk and now, thanks to inflation, they’re paying the price of their greed/stupidity.

What’s even worse is how this has become a double-edged sword thanks to the Neocons in Washington and their blank-check policy to Ukraine.

And NO ONE is holding anyone in Ukraine accountable for where our tax dollars are being spent.

The bottom line is we not only face a banking crisis from an imploding Sovereign Debt massacre, but we cannot control inflation while funding a proxy war with Russia.

Broke Bank Bailout

And now the financial panic in banks has forced First Republic Bank and PacWest Bank into a near collapse state only to be bailed out by JP Morgan and Morgan Stanley.

But lurking in the background is another elephant named Credit Suisse…trading at $2.02 per share.

They’ve been on the ropes for years with all of their exposure to bad mortgages and long-term government bonds.

If they go under it will set off an even wider banking panic.

The other elephant in the room is now that DC doesn’t want to bailout the banks, they will force the banks into doing Bail-ins.

Let’s just hope this doesn’t get worse than the 2008 crisis.

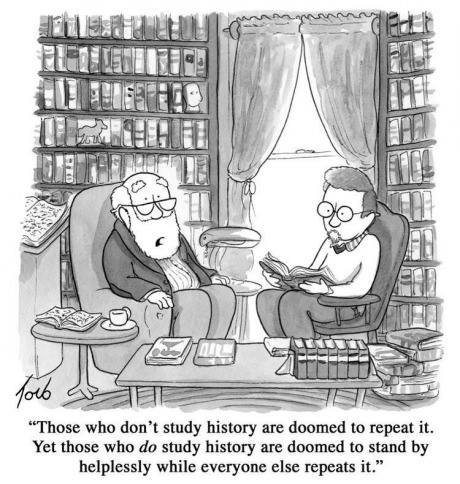

You are soooo right when you say how history repeats because the passions of man never changes.

BTW, I loved your newsletter article this month on Bailouts vs Bail-ins. …Keep up the great work.

**********************************

Thanks, PiP

It’s always great to get a perspective from a viable source other than the media Presstitutes.

As always, if you – our Dear Readers – have a rant you’d like to share then please send it to us.

You never know whose life will be affected by it.

And if you want to see some NSFW rants then go (HERE).

Remember: We’re Not Just About Finance.

But we use finance to give you hope.

***********************************

|

|

You are receiving this email because you opted in via our website.

Yes, amazing how financial wizards in charge of large pools of money haven’t a clue about risk management. I remember many years ago here in California’s Orange county when the county went bankrupt because the paymaster for all the county’s employees had invested his very short term money- all spent money, really on upcoming salary warrants, in long term, high yeild “junk bonds. One hundred percent of it. Well, along came a major downdraft in corperate junk bonds, the portfolio imploded, the county workers got stiffed, and so did bond holders of local munis. I guess they never heard of T- bills and ultra short bond funds for what is basically spent money. I watched that, and I am just a high school graduate truck and bus driver.

You are soooo right, Bart.

And you would think that after the Orange county fiasco you mentioned, and before implying new investment policies that somebody would dare ask the question: “Has this ever worked before?”

But Nooooo!

Now we will suffer.