If there was one single event that illustrates how Wall Street proves that “Heads They Win, Tails We Lose,” it’s the fact that this week is the 15th anniversary of TARP.

In case you forgot, 15 years ago the Troubled Assets Relief Program (TARP) was introduced forced upon tax payers to the tune of $700 Billion dollars to bail out the banksters.

The culprits?

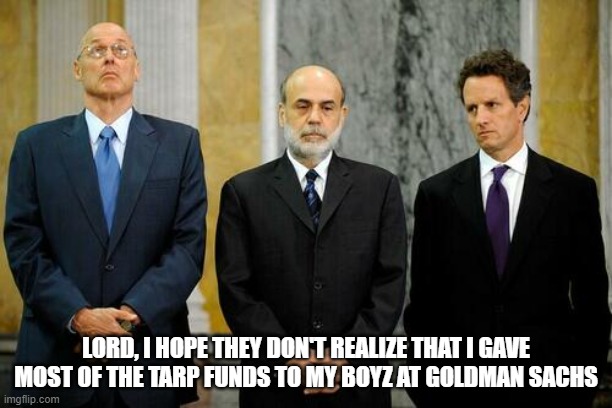

Former Goldman Sachs CEO and Secretary of the Treasury Henry (Hank… “Tanks in the Streets Mr. President”) Paulson, Federal Reserve Chairman Ben (I studied the Great Depression…but didn’t learn from it) Bernanke, and former President of the Federal Reserve Bank of New York, Timothy (Turbo-Timmy) Geithner.

Each man played a key roll forcing our ill-advised/half-baked President “Baby Bush” into the dangerous precedent of saving the Too Big To Fail (TBTF) banks.

And things have never been the same since.

At the time, $700 Billion was a staggering figure.

But now – thanks to out-of-control spending – we throw $100 billion around on proxy wars for ****s and giggles.

These men should be in jail.

But they were recognized as financial heroes in that TARP

“saved” us from the “Great Financial Crisis?”

Nothing could be further from the truth.

Let’s do the math from TARP in real time today.

TARP’s $700 Billion was roughly $70 billion per month.

But when Covid hit – and the fed bought the entire junk bond market and all ETF’s – they were spending $70 billion PER DAY!!!!!

Translation: The currency debauchery decline is logarithmic.

Heads They Win

Looking back 15 years ago it is easy to see why we’re in such a mess with over $31 Trillion in debt.

But you can’t blame it all on Baby Bush (bless his heart) because Paulson said if he didn’t sign TARP that there would be “Tanks in the Street, Mr. President.”

And Bernanke told Congress, that those bailout programs would be short lived, possibly 4-6 quarters.

Meanwhile, Turbo Timmy (not the cartoon character from Fairly Odd Parents) was using his clout to also bail out his former Goldman Sachs Boyz.

Are you seeing a Goldman Sachs Pattern here?

Ironically (or NOT) a lesser-known fact from the meltdown 15 years ago was that a “White Paper,” supposedly written by Satoshi Nakamoto was introduced as financial alternative for investing called “Bitcoin.”

The rest, as they say, is history.

But this story is far from finished.

And it won’t end well…thanks to Wall Street Banksters and their influence control over government.

But don’t let the “heads they win, tails we lose” disturb you.

Instead learn how to profit AND thrive from the destruction of our bond market in the October issue of “…In Plain English” (HERE).

Share this with a friend…especially if they don’t know about the three stooges that hi-jacked our financial system 15 years ago this week.

They’ll thank YOU later.

And tell them:

We’re Not Just About Finance

But we use finance to give you hope.

**************************************

|

|

You are receiving this email because you opted in via our website.

More Stories

Platinum Pushing Purposefully Up

Will Fauci Get Epsteined?

Let’s Tax White Neighborhoods