While everyone freaks out about the FED potentially bringing Fed Fund Rates (FFR) interest rates up to 3%, it’s similar to bringing knives to gun fights.

Translation: Too Little too late.

And the FED knows it.

Fed Chairman Jerome Powell thinks he can fight inflation like Paul Volker did back in 1979-81.

However, Powell’s dream of raising rates to fight inflation is a nightmare for all of us.

Let’s compare some history to see why Powell will fail.

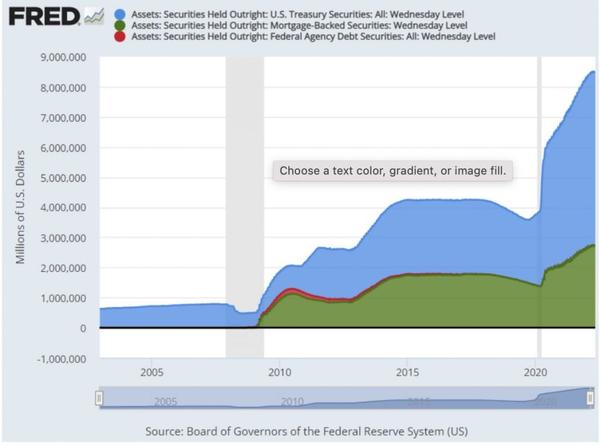

Powell and his predecessors (Greenspan, Bernanke, Yellen) have left our inflation sick nation destitute after inflating the Fed balance sheet from $800Billion, pre-2008, to over $9Trillion today.

(See chart below)

Ironically (or NOT) inflationary consequences of such crazy balance-sheet expansion has everyone in a DC (from Biden to Powell) scrambling to save their reputational behinds.

And they’re attempting to blame the consequences of decades of openly inflationary monetary policies on a virus and Putin.

Knives to a Gun Fight

Sorry Boyz…that’s a bunch of crap.

When Paul Volcker was raising rates, the US public debt was below $900B.

Today our debt level is $30 TRILLION…which the Greenspan generation (including Powell) directly created.

But during the “Volcker era” U.S. debt-to-GDP (Gross Domestic Product) ratio, between 1979 and 1981, was 31%.

And back then our deficit-to-GDP level was only 2%.

TODAY, our debt-to-GDP ratio is over 120% * and our deficit ratio is approaching 7%.

Do the math!

It’s not going to work.

Even if Powel gets the FFR up to 3% it will still be lower than it has been for 98% of the last 67 years.

Here’s the unfortunate truth…

(* GDP growth is mathematically impossible once debt levels are greater than 100%.)

So, what’s going to happen?

The Boyz in the “Club” want inflation to skyrocket.

Huh?

It’s the same with every broke regime throughout history.

Inflate the debt away and default on it.

And by inflating away the debt – crushing the (angry) man on the street in the process – they can (and will) blame the CPI on anyone but themselves?

We’ve been screaming about the dangers of the bond market for years.

Read: https://www.financialsmatter.com/negative-yielding-bonds-surpass-17-trillion/ Nov. 22, 2019

Chickens Coming Home to Roost

And as the chickens come home to roost, you’ll understand why you shouldn’t bring knives to gun fights.

90% of winning is knowing what fights to pick.

So, learn how to fight back every month in our “…In Plain English” newsletter (HERE).

Share this with a friend…even if they’re clueless about the imminent danger in the bond market.

They’ll thank YOU later.

We’re Not Just About Finance.

We simply use finance to give you hope.

https://www.financialsmatter.com/category/in-plain-english/

*********************************

|

|

You are receiving this email because you opted in via our website.

More Stories

Saturday Rant… “Forget Epstein”

How the Markets Influence Governments

Why the Markets Punish Small Investors