If you ask most Americans today, they’ll probably tell you the biggest challenge they face is from skyrocketing food prices and fuel costs.

And it should come as no surprise that Gas prices are around 63% higher than last June.

But what’s worse is the cost of diesel is over double pre-pandemic costs.

And that’s a major factor in rising food prices.

Why?

Shipping via trucks, containers, etc., are dependent on diesel.

Add in the mysterious destruction of over 100 food processing plants – so far in 2022 – and you’re looking at another recipe for disaster from the O’Biden Administration.

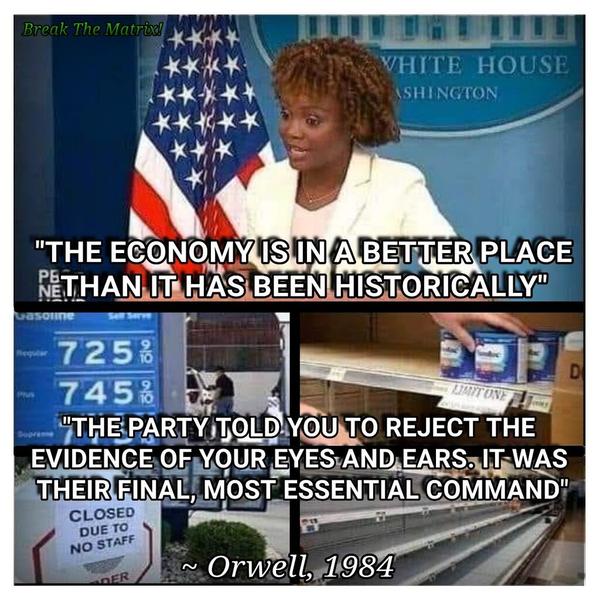

Meanwhile, they attempt to give us their Orwellian explanations that somehow, we’re in one of the greatest economies we’ve ever seen.

Ironically (or NOT) Crude oil supply in the US is at its lowest level since 2004.

And the Farm Bureau noted that in 2020, fuel costs represented around 3% of total on-farm expenditures.

Unfortunately, it is now estimated that the cost of fuel, electricity, and lube will increase by 34% for American farmers in 2022.

BTW…this does not even factor in the fertilizer shortage farmers are facing.

More Problems from Fuel Costs

The Farm Bureau recently reported:

If the U.S. cannot increase production and is not importing the supplemental quantities needed to meet the increased demand, prices could continue to rise. Furthermore, limited domestic refining capacity for those crude oil supplies could further strain supply availability as demand rises, which could also contribute to increased costs.

Bottom Line?

Unless Stinky Joe reverses his executive order – issued within hours after his inauguration – of shutting down our pipelines, food prices and fuel costs will continue to rise.

And that’s all the more reason you need to consider using barter in the future.

Read: https://www.financialsmatter.com/build-back-barter/

In the meantime, don’t be fooled by the sudden drop in oil prices.

Why?

It’s Wall Street’s way of getting you to zig while they zag.

Wait, What?

They want you to think that oil stocks have already run their course…and that they’re going to continue to crash.

Meanwhile, the Boyz are doubling down at discounted prices from recent selloffs.

And you should too.

Is that blunt enough?

Be sure to read our July edition of “…In Plain English” (HERE) where we’ll continue to show you how to prosper AND thrive in Turbulent Times…especially when struggling with rising food prices and fuel costs.

Share this with a friend.

They’ll thank YOU later.

At Financial$Matter We’re Not Just About Finance.

We simply use finance to give you hope.

https://www.financialsmatter.com/category/in-plain-english/

*******************************

Transportation Secretary Buttigieg’s Advice to the Average American…

|

|

You are receiving this email because you opted in via our website.

More Stories

How the Markets Influence Governments

Why the Markets Punish Small Investors

Epstein, the Truth, and Trump