It’s that time of the year again where the talking heads on TV – under the direction of their overlords from Wall Street – begin talking about, “Should you Sell in May and Go Away?”

A lot has been written about getting out of the market for the six-month period between May and November. However, the arguments for staying in the markets are just a valid as Going Away in May.

We’re not going to get into that here but, suffice it to say, this isn’t a new topic.

In fact, the argument for selling in May goes back to 1688 in a book written by Joseph de la Vega called Confusion de Confusiones.

This illustrates how little has changed in the last 330+ years. It’s also a reminder that Wall Street Banksters always do whatever it takes to get you to zig while they zag.

And based on how 2020, The Year of Chaos has been so far, the thought of “Sell in May and Go Away” is looking better for the average investor.

The good news is – if you’re reading this – you’re not the average investor and you’re willing to think outside the box.

The average investor listens to the court jesters on TV (Cough! Jim Kramer) and thinks “Wow! These guys are smart. I should take their advice.”

Ironically (or NOT) the vast majority of financial newscasters have NEVER been traders…yet people act on what these highly overpaid actors/entertainers are telling you.

Let that sink in for a moment.

With the exception of Jim Kramer (who failed miserably as a Hedge Fund manager) the talking heads main talent is their ability to read from a teleprompter.

Let’s get back to the question of should you Sell in May.

The answer is Yes and No.

The yes reasoning applies only to a certain portion of your portfolio.

Example: If you bought stocks in during the month of March, chances are you’ve seen them rebound quite nicely. What do you think the professional traders out there are thinking?

Remember, traders often consider the phrase “long term” as meaning over the weekend.

The no reasoning can be applied with many of your “core holdings” that you’ve held for many years and you’re satisfied with their long-term stability and dividends.

These are the kind of stocks that IF the market takes another dive (which we believe it will) you should consider adding to your position.

However, if you don’t have any cash available it’s hard to buy more stocks…henceforth the argument of “Going Away in May” with a portion of your portfolio.

So, which sectors should you consider selling or buying?

You’re gonna need to read our May newsletter to find out.

If you’re not already a subscriber, why not consider investing a whopping $8.75 for one month’s subscription?

It’s a pittance compared to what you’ll get in return…And if you only get one idea that can make OR save you a fortune, why wouldn’t you want to take advantage of it?

More Stories

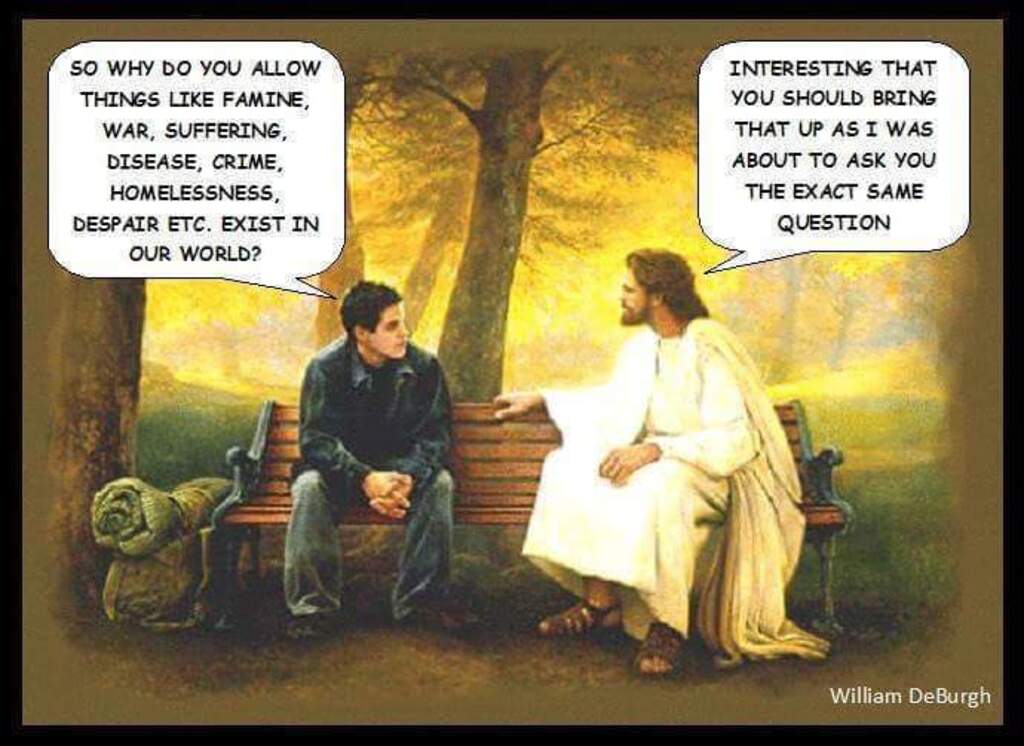

The Reverend of Finance

Saturday Rant… “Forget Epstein”

How the Markets Influence Governments