In the past we’ve written many times about why you should hate mutual funds and ETFs.

READ:

- How Mutual Funds Cover a Multitude of Sins (HERE)

- Another Reason to Hate ETFs/Mutual Funds (HERE)

- Why You Shouldn’t Buy WOKE Mutual Funds (HERE)

- Why You Should Hate Mutual Funds (HERE)

And now, according to Visual Capitalist’s Dorothy Neufeld, the performance over a 20-year period shows 95% of large-cap actively managed funds have underperformed their benchmark.

As with most money managers the ‘benchmark’ is the S&P 500.

Ironically (or NOT) the supposed legendary Warren Buffett’s firm Berkshire Hathaway has only beaten the S&P 500 two-thirds of the time.

This shows that even the world’s top stock pickers have a hard time beating the market’s returns.

Hate Mutual Funds More in a Market Crash

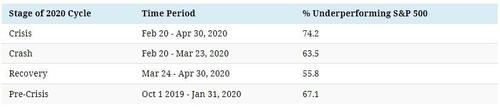

And if you’re wondering how ‘actively managed funds’ perform during a market crash simply look at what happened in 2020 during the CoronaHoax meltdown.

Many Wall Street Guru Wannabes (Cough! Jim Cramer, Cough! Cough!) will tell you how actively managed funds are often stronger during a market downturn.

But, a 2020 study shows how they continued to underperform the index…Overall, 74% of over 3,600 active funds (with $4.9 trillion in assets) did worse than the S&P 500 during the 2020 market plunge.

One of the biggest problems with most funds/ETFs is that there are more funds competing with each other than there are stocks available to choose from.

Translation: They’re all buying the same stocks…and often trading them among their own family of funds.

READ: The Difference Between Guns and ETFs Is… December 11, 2021 (HERE)

So, choosing the top funds year after year can be challenging.

And that’s because good active fund managers typically only run a portfolio for four and a half years on average before someone new takes over.

That means right about the time you think you have a winner; Wall Street woos them away – with millions of up-front monies – to another fund.

And have you ever wondered why Money Magazine never shows their Top Mutual Funds winning the award two or three years in a row?

It’s because no fund has ever done it.

So, what can you do about it?

First, stop chasing performance that’s skewed by Wall Street Guru Wannabes.

Second, start looking at companies that pay dividends…and have a history of increasing their dividends every year (See a list in this month’s newsletter HERE).

Third, stop trying to hit home runs as a stock picker.

Why?

Because the best performance over time comes from hitting a lot of singles, doubles, and occasionally triples.

Share this with a friend…especially if they complain about never making money in the markets.

They’ll thank YOU later.

Remember:

We’re Not Just About Finance

But we use finance to give you hope.

*********************************

|

|

You are receiving this email because you opted in via our website.

More Stories

Having Skin in the Game?

Saturday Rant…Woke is Dead

Trump Said, What?