In Case You Missed it…our national debt is now way over $37 Trillion.

And the Boyz in the District of Corruption are borrowing over $6 billion per day—just to keep the lights on.

And with interest payments alone topping $1 trillion annually, there’s only one path forward.

Let’s print more money.

Cue Up: Trump’s “Big, Beautiful Bill” that they’re calling a win for the economy…

But to anyone who understands history—or math—it’s a neon warning sign flashing DANGER AHEAD.

Because anyone who is capable of critical thinking knows that printing more money eventually means the purchasing power of the US dollar—the value stored in your retirement, savings, or brokerage account—is being systematically destroyed.

So, if you feel like things are getting more expensive, faster than ever… It’s not your imagination.

It’s by design.

Because when the government can’t pay its bills, it prints money to cover the difference.

It’s a vicious cycle.

And Trump’s Big Beautiful Bill is at the center of this cycle.

$37 Trillion in Debt

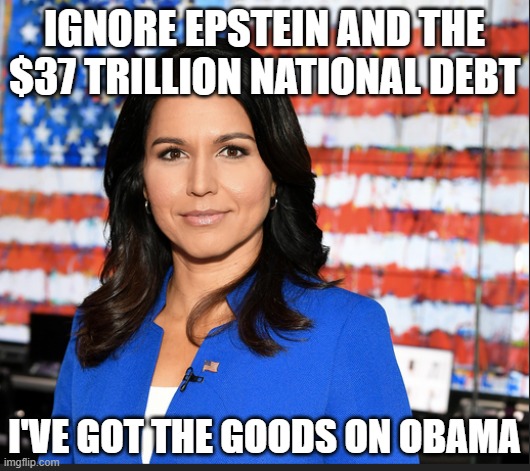

Meanwhile, major media distractions like Epstein’s List, and now Tulsi Gabbard releasing more “Russiagate Files” will capture the public’s unquenchable appetite for the latest “Look Here, Don’t Look There” tactic so you don’t see how Trump’s bill is socialism in red-state clothing.

Think we’re kidding?

The bottom line of this bill is that it directs a lot more power and dollars toward the State—and in no way cuts it back.

There are no tax cuts, no deregulation, and no attempt to reduce government waste.

It’s just more chaos, more complexity, more debt, and more power handed to the same people who created the problem.

Furthermore, this bill is not just irresponsible spending.

It’s a strategic transfer of wealth—from everyday Americans who are already being crushed by inflation, to the politically connected institutions that own the debt.

So, the $64 Billion Dollar question is: What can we do about it?

Unfortunately, we cannot stop what is already in motion because Republicans are just as reckless as the Democrats they allegedly oppose.

But, as an investor, you can take steps to protect and enhance your investments against the inevitable Sovereign Debt Default.

READ: Climate Change…the Cover for Default (HERE)

You can also read our upcoming August edition of “Simplifying Wall Street…In Plain English” (HERE) for a list of actionable ideas specifically designed to help you prosper AND thrive in Turbulent Times.

Share this with a friend…especially if they are enamored over Tulsi Gabbard’s latest distraction about Obama and the Russiagate Hoax. They’ll thank YOU later.

And tell them:

We’re Not Just About Finance

But we use finance to give you hope.

“And you shall know the truth, and the truth shall make you free.”

~John 8:32~

More Stories

Saturday Rant…Epstein vs Genius Act

Why You Should Buy More Gold…Putin!

Inflation is NOT Under Control