Contrary to what the recent government numbers are saying, inflation is not under control.

According to the Boyz, Core inflation is mild with “only” a 2.9% annualized rise.

Sorry/not Sorry but this is not cause for relief.

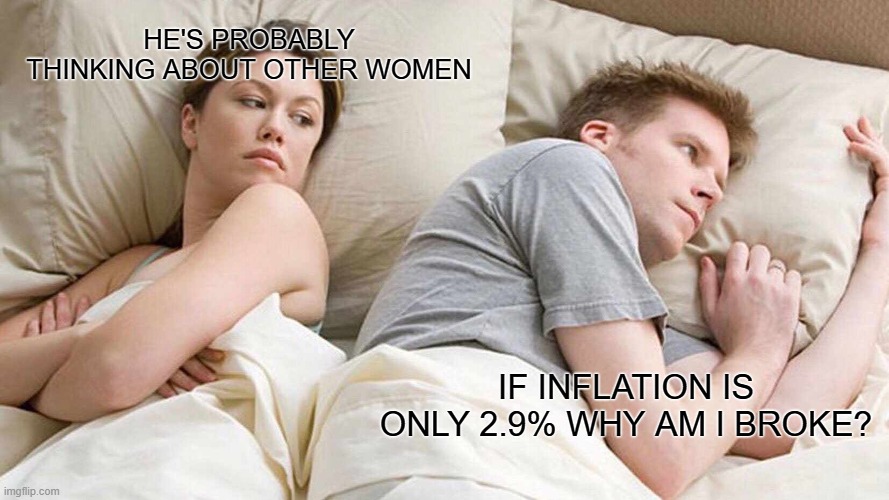

Seriously, who in their right mind believe that inflation is only 2.9% on an annual basis?

Because here’s what they are not telling you.

- Prices have simply not returned to what they once were before the global economy came to a standstill during the COVID Hoax.

- Every nation has been affected.

- The lockdowns and supply chain cracks were exacerbated by a massive increase of government spending.

- Then the government doubled down on green policies, causing energy prices to rise, and lit the situation ablaze amid the Ukraine war and Russian sanctions.

The world was already amid a sovereign debt crisis before COVID…and it has only gotten worse.

Not Under Control

The Boyz make it sound like things are improving with numbers like a 2.9% increase.

But…and this is a Very VERY Big Butt…

They don’t say how the 2.9% is on top of the massive run-up in prices in essentials like gasoline, food, Medical services, shelter, apparel, and everything else that has been significantly more expensive since the Covid Hoax.

Is there anyone out there who thinks the cost of living is cheaper today than it was 3, 4, or even 5 years ago?

Crickets…

Before Trump took office, we said that the inflationary trend, which has become stagflation, would be blamed on Trump’s policy.

True to form, Fed Chairman Jerome Powell said at the recent European Central Bank forum in Sintra, Portugal;

“In effect, we went on hold when we saw the size of the tariffs and essentially all inflation forecasts for the United States went up materially as a consequence of the tariffs.”

Translation: Inflation has been above target for years and the Fed simply cannot control the trend.

As a result, you should continue to expect a cautious Fed.

And you can expect politicians to blame their opponents, as always, rather than seeking the actual cause.

Because politicians rely on academics who do not understand how the economy functions at its core and rely on outdated concepts that do not reflect the current landscape.

But real culprit is how cyclical history is repeating itself.

And it flows like this:

- Trade policy swings (Tariffs)

- Inflationary follow-through (“Inflation is under control”)

- Central bank reaction (Trump’s fault)

- And then economic slowdown (markets puking)

Here’s the point.

We are only in the early stages of the cycle.

And 2026 will be much worse.

So, learn how to position your investments for the inevitable by reading our July issue of “Simplifying Wall Street…In Plain English” (HERE).

Share this with a friend…especially if they complain about the cost of groceries, healthcare, etc. They’ll thank YOU later.

And tell them:

We’re Not Just About Finance

But we use finance to give you hope.

“And you shall know the truth, and the truth shall make you free.”

~John 8:32~

More Stories

Spending $1.59 Trillion from NATO

Another All Time High for Gold, Again

How to Destroy a Society