Goldman Sachs is saying to investors that mutual funds have missed rally recently and they now face critical issues.

According to Goldman (“The Squid”) fund managers must either chase the rally or wait for a pullback.

But before you act on Goldman’s recommendation, remember that this is the same firm who caused most of the carnage in the 2008 meltdown starting with bogus mortgages.

Remember that?

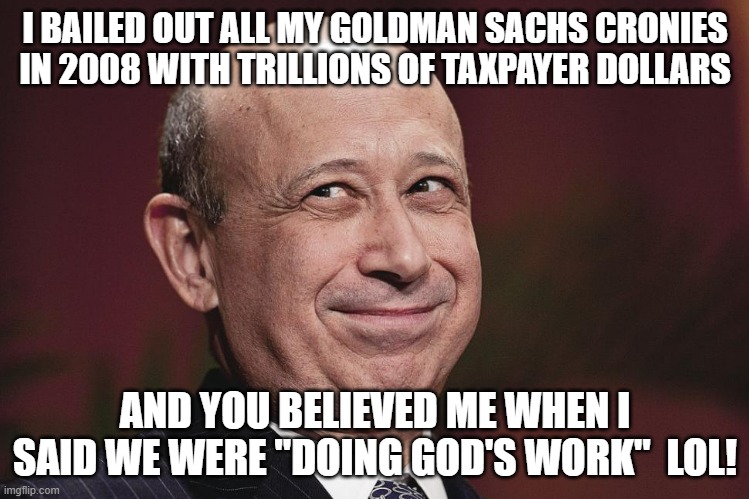

And then, after getting the lion’s share of the $700 Billion TARP Bill (from former Goldman CEO and then current Secretary of Treasury, Henry ‘Hank’ Paulson) they immediately bailed themselves out AND their favorite cronies and had the audacity to tell us they, and their fellow banksters:

“We’re Doing God’s Work Here”

~ Lloyd Blankfein, Nov, 9, 2009 ~

And most people are still unaware how they also used TARP to torpedo Lehman Brothers, forcing them into bankruptcy and then picking Lehman’s carcass clean for pennies on the dollar.

It was a classic story of how vindictive Wall Street firms can be when getting revenge even among fellow members of the “Club.”

READ: The Gospel According to Goldman Sachs (The Squid) May 1, 2018 (HERE)

But that’s another story for another time that you can find in our archives by doing a search on Goldman Sachs.

The fact that we are hearing Goldman Sachs pontificating today about how mutual funds “missed the recent rally” is most likely because THEY missed the rally.

And they are trying to cover their tracks so their clients won’t discover how Goldman traded against them.

Wait! What?

Goldman trades against their own clients?

In a word, YES.

And it’s one of the best kept secrets behind the curtain on Wall Street…and they are not the only ones who do it (Cough! Jamie Dimon/JP Morgan, Cough! Cough!).

Funds Missed Rally…Really?

Sadly, far too many investors hear something like Goldman saying how mutual funds missed a rally and hang on every word waiting for the Squid to give the public all their trading recommendations.

And they do it hoping you will chase the rally to the upside while they sell into the retail buying.

Then, after the market has an additional 15% upside move – and everyone is feeling happy, confident, and thinking they are sooo smart – the market conveniently gets the rug pulled out from underneath.

And guess who is waiting with a bushel full of cash to catch all their favorite stocks as they tumble in a nose-bleed drop while the average investor cries.

This is nothing new, folks.

And it’s been that way for over 100 years.

So, don’t be fooled by the Boyz in the “Club” when they try to get you to Zig while they Zag.

And learn how to trade with them instead of against them in our upcoming June edition of “Simplifying Wall Street…In Plain English” (HERE).

Share this with a friend…especially if they remember the 2008 meltdown. They’ll thank YOU later.

And tell them:

We’re Not Just About Finance

But we use finance to give you hope.

“And you shall know the truth, and the truth shall make you free.”

~John 8:32~

More Stories

Saturday Rant…Boris Translates Putin

Democrats Are Desperate Again

War is ALWAYS About the Money