How quickly we forget events like the major Short-Squeeze of 2021 involving GameStop (GME) with the Robinhood Millennials, Aka: “Roaring Kitty Bandits” clipping the wings of several evil Wall Street Hedge funds in the process.

Remember that?

GME went from under $20 to over $483 in a few days.

READ: Is GameStop About to GameDrop? (HERE)

But now, short-squeezing your way to riches and fame is making a huge comeback for all the basement-dwelling retail traders.

Cue Up: Opendoor Technologies (OPEN) stock (and Chamath SPAC).

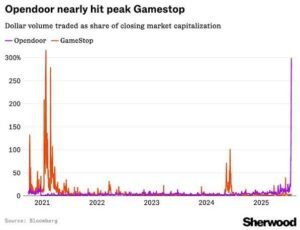

The chart below shows how OPEN’s recent activity is similar to GME in 2021.

Ironically (or NOT) Goldman Sachs has chimed in with their $0.75 cents worth (adjusted for inflation) saying:

“2021 vibes … feels chasey out there: calls are almost 70% of the total market volume … hasn’t been this high since 2021 meme days.“

In Case You Missed it…back in 2021, Goldman took a huge hit to the tune of billions in losses as they tried to flex their collective muscles attempting to swat those pesky Robinhood traders.

Short-Squeeze Redux?

And in case you forgot, during the 2021 GME Short-Squeeze, the Robinhood notifications that some stocks were “frozen” and unable to trade, started showing up after Goldman was getting their a** kicked.

Meanwhile, the prices kept changing.

As a result, the Robinhood gang eventually felt the wrath of trying slay Goliath thinking they could do it without the faith of David and some divine intervention.

Fast forward to today where we will most likely see a repeat of 2021 with the basement-dwelling traders sticking around too long – thinking they are invincible – and end up losing Bigly.

Remember traders: The goal is to buy low and sell high.

And that highly-successful traders, such as Congresswoman Nancy Pelosi and Congressman Dan Crenshaw, have special mystic powers that enable them to predict the market and receive very generous returns.

One final note…

Whenever we get here, folks, it indicates the market run is on its very last leg.

Because these are the runners that move last, as the big money has already moved the fundamentally strong names to where they can no longer go much farther.

And when your “Cousin Eddie” tells you about these great opportunities, remember, by the time your relatives hear about it, it’s too late.

And we all know what happens after that.

The Boyz are, once again, waiting in the wings and ready to pounce on retail investors.

Because they know that the 99% must be wrong in order for the 1% to make fortunes…at your expense.

Don’t be their victim!

Instead, learn how to avoid their traps while prospering AND thriving in Turbulent Times (HERE).

Share this with a friend…especially if they think they will get rich in the latest Short-Squeeze on Wall Street. They’ll thank YOU later.

And tell them:

We’re Not Just About Finance

But we use finance to give you hope.

“And you shall know the truth, and the truth shall make you free.”

~John 8:32~

More Stories

Saturday Rant…Was It Something We Said?

There Are No Shortages…

Spending $1.59 Trillion from NATO